Steve Jurvetson, a venture capitalist with a pretty good track record of spotting trends in disruptive technologies, says that “unless something falls off the rails, we will soon (in the next couple of years), have computers that can outperform any computer on earth”. He points out that Google’s quantum computer (purchased from a company called D-Wave), already outperforms their entire data center on certain computational tasks – in some instances at 100 million-fold speed over the best computers they could buy from anyone else. According to Jurvetson, quantum computers are on an exponential growth curve – a continuation of Moore’s law.

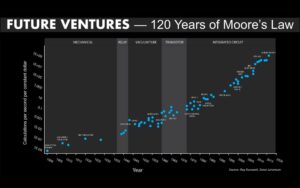

One of Steve Jurvetson’s favorite illustrations of the exponential growth in computational power, is a graph showing Moore’s Law over 120 years. First presented in The Age of Spiritual Machines (a non-fiction book by inventor and futurist Ray Kurzweil), the graph shows that computational power is on a smooth geometric compounding curve that predates the integrated circuit and is transitioning beyond the IC, into the era of quantum computing. Jurvetson goes as far to say that this is the most important graph in history – one that eloquently predicts our future.

One of Steve Jurvetson’s favorite illustrations of the exponential growth in computational power, is a graph showing Moore’s Law over 120 years. First presented in The Age of Spiritual Machines (a non-fiction book by inventor and futurist Ray Kurzweil), the graph shows that computational power is on a smooth geometric compounding curve that predates the integrated circuit and is transitioning beyond the IC, into the era of quantum computing. Jurvetson goes as far to say that this is the most important graph in history – one that eloquently predicts our future.

Presuming that the 120 year trend will continue, Jurvetson points to a thought experiment performed by University of Oxford physicist David Deutsch, about the processing capacity of quantum computers in the near future. “Give it another couple of years and they will outperform all computers that could ever be built on earth, even if you use the entire matter of the earth to build them. And then give it another couple of years and they will outperform all computers that could possibly be built – even if you use the entire matter of the universe at your disposal to build the best possible computer any human could ever design, and you gave it the length of the universe in time to work on a problem, it still couldn’t solve the problems that the quantum computer could, in due course, in less than an hour.”

So what are the implications of next-generation computers with nearly unlimited computational power? Jurvetson believes that, in the not-too-distant future, quantum computing has the power to transform every industry in the world. The exponential cost declines in computational power will trigger a transition from the science of trial and error experimentation, into a simulation science that will accelerate the pace of progress dramatically. In essence, every business on our planet is going to become an information business.

Consider agriculture. Jurvetson says if you ask a farmer 20 years into the future about how they compete, it will depend on information – from computing data from satellite imagery to drive robotic field optimization, to programming the genetic code in seeds. It’ll have nothing to do with workmanship or labor – the historical basis of competition. In biotechnology, quantum computing will improve the way medicines are developed by simulating molecular processes. In finance, it will speed up and optimize portfolio optimization, risk modeling and derivatives creation. In cybersecurity, it will disrupt the way we think about encryption. Quantum computing will create superior weather forecasting models and help us fight climate change. In transportation, it will unlock advancements in autonomous vehicle technology and reduce energy loss in batteries through optimized routing and design, thereby enabling hyper-efficient electric car batteries. But these are just a few examples. Quantum computing has the potential to disrupt virtually every industry we can think of, and no doubt, things we haven’t yet contemplated.

If Steve Jurvetson is correct, and this emerging field has the potential to perforate into every industry on the planet, then its important for investors to take a position in companies advancing this important technology. Choose the right companies, those that ride quantum computing’s exponential growth curve, and you have the real possibility of seeing similarly explosive growth in the value of your portfolio.

Top Quantum Computing Stocks

So which companies are actively involved in the development of quantum computing? Below we’ve listed eight of the industry leaders, all of whom are involved in the race to create quantum computers and/or peripheral technologies.

Alphabet, parent company of Google, is one of the front runners in quantum computing. It’s quantum computing arm – Google AI Quantum – made a groundbreaking announcement in October 2019, when it claimed that its state-of-the-art quantum computer, named Sycamore, achieved “quantum supremacy” over the most powerful supercomputers in the world (when it solved a problem considered virtually impossible for normal computers). In the future, Alphabet has the ability to integrate its quantum computing arm with its Google Cloud business, to create a market-leading quantum-computing-as-a-service business.

Baidu, China’s largest search engine, launched its own quantum computing research center in 2018. Instead of plans to sell quantum-computing-as-a-service, Baidu’s strategy is to integrate quantum computing into its core business in order to improve its own operations. In particular, its core search and advertising businesses could markedly improve with quantum computing, allowing the company to dramatically improve search algorithms and ad-targeting techniques.

International Business Machines (IBM), via it’s quantum initiative IBM Quantum, seeks to build universal quantum computers for business, engineering and science. This effort includes advancing the entire quantum computing technology stack and exploring applications to make quantum computing broadly usable and accessible. IBM’s philosophy differs slightly from that of other players in the quantum computing arena. Instead of striving for “quantum supremacy” versus traditional computing (like Google AI Quantum), IBM Quantum is focused on making quantum computers measurably more useful and economical, in certain industry verticals, for certain tasks.

Quantum Computing Inc. is building a portfolio of affordable quantum computing software that can also be run on traditional legacy supercomputers. Following such a strategy, they are striving to become a widespread, low-cost provider of easily accessible quantum computing software for organizations that cannot afford full-scale quantum computing hardware. As of 2020, Quantum Computing Inc. has developed early software products serving the financial, health care and government sectors, and has started signing up customers in the respective areas. With a very small market cap compared to other companies on the list, Quantum Computing Inc. is certainly the riskiest, but also has explosive upside potential.