Born on January 3, 2009, bitcoin is a little over one decade old. Yet a surprising number of people believe this first-generation cryptocurrency is immutable and indestructible. A little over a decade in, and some are proclaiming its the new gold. But with the accelerating growth in quantum computing power, how long can bitcoin’s reputation remain untarnished? Truth is, the threat to bitcoin’s integrity may be approaching far faster than most people realize. From a 30,000 foot perspective, bitcoin might just be a short blip in the history books, just like many of the fiat currencies that have come and gone.

Bitcoin – Store of Value or Speculative Asset?

Bitcoin Is The “New Gold”

Many crypto enthusiasts are proclaiming that bitcoin is the new gold. Bitcoin is a legitimate store of value because its unbreakable. After all, it has an entire 12 year track record behind it. Gold on the other hand, its a relic. Never mind that gold has thousands of years of history as sound money. Never mind that you need rare neutron-star collisions to produce the stuff. Because bitcoin is gold in a digital form. It represents the future of money.

Shor and Grover’s Algorithms

But a whole 12 years into “immutable” and there’s already a slight glitch in bitcoin’s armor. Algorithms that can decipher bitcoin’s private keys already exist. Shor’s algorithm and Grover’s algorithm, devised in 1994 and 1996 respectively, can be used to challenge asymmetric cryptography and hashing – the two mechanisms that secure a blockchain. And although we still don’t have computers powerful enough to execute these algorithms, most experts believe its not a question of if, but when this day will come.

The defense used by bitcoin bulls is…

- It’ll be a long time until quantum computers have the power to run such algorithms.

- Blockchain technology will likely have bolstered its defenses by the time a powerful enough quantum computer is developed.

While each of these arguments are valid, there’s also an awful lot of grey area and conjecture in them. Truth is, none of us have a crystal ball. Even among experts, there’s a lot of divergence in opinion. Some, like Alphabet CEO Sundar Pichai, tell us crypto-breaking quantum computers will be able to break encryption within as little as five years. Others believe its still a decade away. Others, like encryption experts Andersen Cheng and David Williams, believe that nation-states or other companies may be working in “dark mode”, so the threat may be inside of the the five year window. Truth be told, when dealing with the complexity of computers that harnesses the phenomena of quantum mechanics, its anyone’s guess. The only thing we know for sure, is the pace of mind-blowing breakthroughs (given the history of exponential growth in computing power), is certain to surprise us all.

Bitcoin’s Price After the First Quantum Attack

So what happens to the price of bitcoin if/when it becomes evident that quantum computers are powerful enough to run crypto-breaking algorithms? Its really not that complicated. Bitcoin, and the entire digital currency world, is based on trust and the security of private key signing. When that trust is gone, the value of bitcoin goes to zero, immediately.

Tik Tok – Bitcoin’s Days Are Numbered

The probability of breaking bitcoin is ticking up each and every day. And for those that think bitcoin is safe – that it still has another decade or two before quantum computers are powerful enough to break cryptography – then they’re forgetting the historical growth curve of computer processing. They’re forgetting the disruptive power of compounding.

Give it another couple of years and they will outperform all computers that could ever be built on earth, even if you use the entire matter of the earth to build them. And then give it another couple of years and they will outperform all computers that could possibly be built – even if you use the entire matter of the universe at your disposal to build the best possible computer any human could ever design, and you gave it the length of the universe in time to work on a problem, it still couldn’t solve the problems that the quantum computer could, in due course, in less than an hour. – UNIVERSITY OF OXFORD PHYSICIST DAVID DEUTSCH

As Peter Diamandis and Steven Kotler point out in their book The Future is Faster Than You Think, the human brain is not wired to think in exponential terms, so for many, this might sound a little over-the-top. But even if we simply continue to follow the trajectory of Moore’s Law in binary computing (the observation that the number of transistors in a dense integrated circuit doubles approximately every two years), then quantum computing has the power to cause disruption much sooner than most believe.

Quantum Computing In the News (What They’re Telling Us)

As news stories of the last 6 to 12 months prove, advances in quantum computing are shattering even the most optimistic predictions. The pace of innovation in quantum computing is starting to look like Moore’s Law on steroids.

-

- Engineers make critical advance in quantum computer design

- Triple entanglement in silicon marks major quantum computer breakthrough

- Harvard-MIT Quantum Computing Breakthrough – “We Are Entering a Completely New Part of the Quantum World”

- Scientists discover ‘missing piece’ in quantum computing breakthrough

- Google Gets Us Closer To Error-Corrected Quantum Computing

- There’s been another huge quantum computing breakthrough

What Aren’t They Telling Us??

Quantum computing is far and away the most powerful weapon any government (or non-government entity) can possess. Even if you isolate one simple use case – the ability to break cryptography – this gives the frontrunner in quantum computing an unfair advantage over the competition. So is it realistic to believe that nations and corporations are sitting back and taking a watch and see approach to the technology? Of course not. They fully understand the importance of gaining a first-mover advantage. For most, its literally life and death. So they’re dumping money, hand-over-fist, into development, trying to take a crucial early lead.

And the news stories, as exciting as they are, only give us a very small glimpse of what’s going on. When first mover advantage is so crucial, who’s going to reveal their hand? With so much on the line, just imagine the size and secrecy of these projects. For instance, what’s the real origin story of bitcoin and Satoshi Nakamoto? Truth is we don’t know. Like an iceberg, there’s a whole bunch we don’t see, that’s lurking beneath the surface.

Circle of Competence

The most common way people lose money is to overestimate how clever they are and how much they know. They invest in things outside of their circle of competence – a mental model prescribed by Warren Buffet to help investors stay out of investments they don’t understand. Buffett contends that he isn’t bothered when he misses out on big returns in areas he doesn’t understand, because investors can do very well (as he has) by simply avoiding big mistakes. He believes that what counts most for investors is not so much what they know, but how realistically they can define what they don’t know.

In finance, very few people – with the exception of the market greats – operate within this inner circle. The overwhelming majority of investors (and financial professionals), operate in their outer circle. They operate in the space they “think” they know. This is especially true in the complex space of cryptocurrencies. Most bitcoin proponents profess their knowledge of the blockchain and decentralized finance. And sure they may understand the fundamentals of cryptography and the argument for sound money, but in all honesty, how well do they truly understand the underlying complexities surrounding the technology?

Bitcoin Bulls Are Suddenly “Experts” In Quantum Computing

Many financial pundits state, with a certain amount of certainty, that quantum computing is no threat to bitcoin’s integrity. But to understand how long bitcoin will remain immutable and indelible, you need a deep knowledge in quantum computing and quantum mechanics. And even though most quantum physicists admit that they have a limited understanding of quantum mechanics – how to account for the properties of electrons, protons, neutrons, and other more esoteric particles such as quarks and gluons – bitcoin bulls are convinced they understand the future trajectory of quantum computing.

Outright Hubris and the Nature of Bubbles

One of the dangers of operating outside your inner circle of competence, especially after encountering a period of success, is outright hubris. Especially true during speculative bubbles, hubris is characterized by excessive confidence or arrogance. It leads to a lack of self-awareness and the belief that you can do no wrong. In most cases, hubris becomes all-consuming. Inevitably, it leads to the individual’s downfall.

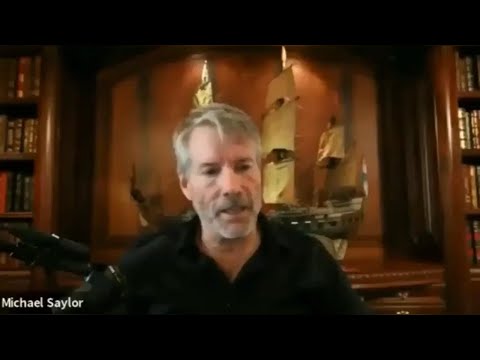

Michael Saylor – the Chairman & CEO of MicroStrategy (MSTR), a publicly traded company which provides business intelligence, mobile software, and cloud-based services.

The fundamental cause of the trouble in the modern world today is that the stupid are cocksure while the intelligent are full of doubt. – BERTRAND RUSSELL

When asked about the threat from quantum computers, pundits like Michael Saylor just scoff and say, “not in my lifetime.” Or, “bitcoin has time to solve for this threat.” But as per Buffet’s principle, are they truly operating from their inner circle? Perhaps they just can’t contemplate the speed of innovation occurring in quantum computing?

Instead of slowing down and asking, am I operating within my circle of competence, the bitcoin bulls are letting the same irrational exuberance, typical in all self-perpetuating bubbles, cloud their reasoning. They’re extremely confident and dismissing the obvious risks. And it may be to their peril. Because bitcoin’s time is limited. And the countdown clock is ticking. The question isn’t really if, but when bitcoin’s time finally runs out.