According to corporate dealmaker Carl Allen, younger generations (Gen-X, Millennials, and Gen-Z) have a wonderful opportunity to profit from a huge demographic trend – Baby Boomers who want to retire from their businesses, but have no one to sell to. The number of entrepreneurs who are going to retire over the next 10 to 20 years, versus that of young qualified buyers who are just coming into business, is disproportionate. The opportunities are insane.

Carl Allen – editor of Dealmaker Wealth Society, Carl is an entrepreneur, private equity investor and corporate dealmaker who’s worked on acquisitions and sales worth over $48 billion.

Baby Boomers Want To Retire – Deluge of Businesses For Sale

There are millions of entrepreneurs in America who are getting older and want to retire, but have no one to sell their businesses to. There are simply too few young entrepreneurs with the know-how, or desire, to purchase their businesses. According to the United States Census Bureau, there are an estimated 73 million Baby Boomers in the US alone, all of whom will reach the age of 65 by 2030. And amongst their assets, there are 12 million privately owned businesses.

This means that every single day, there are literally thousands of new sellers going to market to try and get rid of their businesses. They’re done. They want to retire. But with an insufficient amount of buyers with the access to capital and/or the sophistication to find and close on a deal, only one in twelve or thirteen business owners are able to sell (according to Carl Allen’s estimates). For the remainder, the only other option is to shut the doors and turn out the lights.

This means that every single day, there are literally thousands of new sellers going to market to try and get rid of their businesses. They’re done. They want to retire. But with an insufficient amount of buyers with the access to capital and/or the sophistication to find and close on a deal, only one in twelve or thirteen business owners are able to sell (according to Carl Allen’s estimates). For the remainder, the only other option is to shut the doors and turn out the lights.

Four Ways To Profit From This Trend

The simple fact is, more millionaires will be made via this demographic trend than by business startups (those entrepreneurs starting from scratch), or by real estate investing, crypto investing, or investing in the stock market. How exactly? You need to learn the skills of a competent dealmaker, then employ one of the following methods…

Buy A Business And Run It For Cash Flow

Buy a pre-existing businesses and operate it for it’s high-yielding cash flows.

Buy It, Grow It, Sell It

Buy a pre-existing business, make improvements (to marketing, operating procedures, etc.), grow sales, then sell it and realize capital gains on top of several years of cash flow. For example, if you buy a business for $400,000 (using seller financing), and grow the business to where its doing $500,000 in free cash flow, then you can probably sell it for at least $1,250,000 ($500,000 x 2.5 times multiple). If you had run the business for 3 years, you’ve have taken out, more or less, another $1,250,000 in earnings (earnings minus 10% payout to the seller per year). Now after you sell the business, you’re left with approximately $2,200,000 ($1.5 million capital gains + 1.5 million in earnings – $280,000 still owed to the original seller). Not bad for a 3 year investment with no money down and little risk.

Do A Roll-Up And Enjoy Economies Of Scale

When you buy multiple businesses in the same sector (called a roll-up), you create economies of scale that will generate cost savings. For example, if you are buying cleaning businesses, one of the biggest expenses is capital equipment. And the more equipment you buy, the less you pay per unit. So all that cost savings drops to the bottom line and your cash flow goes up even more.

Do A Roll-Up And Sell For A Higher Multiple

When you buy individual business units in the same sector, or in complementary sectors, then bundle them into one company, this will raise the multiple of the individual businesses. This is thanks to a reduction in costs through economies of scale, plus a multiplier effect in revenues when combining two synergistic companies. So the original 2.5x multiple for individual business units (for example), jumps to a 3x or 4x multiple when bundled together. And now that you are selling to “bigger fish”, you sell the lot to a new owner for the higher multiple, and pocket the difference.

Why Buy A Business? Why Not Just Start One?

Carl Allen says entrepreneur should think twice before starting a business. Instead, they should buy. When you drop yourself into a business, he argues, you are bypassing the time, money, sweat and headaches that it took the cash-flowing business to get to its current level. You are essentially leveraging someone else’s time and money.

Allen likes to explain this concept using analogies. For example: is the only way to make money in real estate to buy the land, put in the utilities, pour the foundation, build the building? Of course not. Most people buy a preexisting building, then either renovate it, change the use, manage it better, market it better, and increase the value. The same is true for businesses.

If you look at the Forbes 500 , you’ll see a large percentage of the individuals on the list who made their fortunes, not from starting from scratch, but from buying existing businesses or business ideas.

- Ray Kroc bought McDonald’s from the McDonald brothers

- Bill Gates (Microsoft) bought what became MS DOS from Seattle Computer Products

- Dana White and partners bought UFC from Semaphore Entertainment Group

- Warren Buffet (Berkshire Hathaway) bought GEICO (Government Employees Insurance Company)

There are many benefits of buying an existing business versus starting a business from scratch.

- First and foremost, roughly 80% of business startups fail. That’s really poor odds. When buying an existing business on the other hand, you immediately start with profitability, which drastically reduces odds of business failure.

- When purchasing an existing business, you are leveraging the time and money the original owners have already put into the business. And those that get ahead of the crowd financially, generally do so by leveraging time and/or money.

- Existing businesses have a customer base that is already built in, reducing the cost of customer acquisition.

- Since existing businesses already have an income stream, its much easier to raise capital. Financial institutions will give much better terms to a business that is making money versus one that is not.

How To Find A Good Business To Buy

Carl Allen outlines a number of key criteria when searching for the right business. You need to find motivated sellers. You need to find sellers who value their business’s legacy over and above the final price. And you need to find businesses for which you have an aligned passion and/or skill set – so you can step in and add immediate value. This means you have to be creative in deal origination, know how to build rapport with sellers, look at a broad range of opportunities, and be ready to walk away from an imperfect deal. There’s so many good deals out there, you don’t have to settle.

Seek Out Motivated Sellers

The first key to finding good businesses for sale, is identifying highly motivated sellers. These are predominately business owners who are retiring, but may also include those with health issues or a partner with health issues, someone who is divorcing, someone who is moving, or someone suffering from burnout who simply needs a change.

Understand The Seller’s Psychology

The second key is understanding the seller’s psychology – what is the seller’s motivation? Buying a small business, according Allen, is 90% psychology and only 10% numbers. So when buying a business from a small business owner, its really a game of understanding what motivates the seller and building relationships.

After interviewing over 2000 people that have sold their businesses, Allen found 79% of people didn’t actually sell their businesses with the financial outcome in mind. Rather, they were more concerned with leaving a legacy, leaving their business in a safe set of hands to someone who would protect their employees, protect their customers, safeguard the business culture, and maintain their reputation in the marketplace. In a lot of cases, Allen says, its a lot like they’re giving their children away. They want to see their business thrive and survive.

The number of sellers that I’ve met, that care more about their name above the door than the amount of money they’re getting, it’s crazy. It’s all about pride. It’s all about psychology.

Its also important to understand that the number one exit strategy for small business owners looking to retire, is to simply close the doors and turn off the lights. There simply aren’t enough buyers. With this in mind, and once you build rapport with the seller, you can ask them: “How important is it for you to to retire and see your business continue to prosper?”

If they answer “quite important”, you’re now in a position to structure a deal based on seller financing – one that not only reduces risk for both parties, but mutually increases earnings as well. (Read more about deal negotiation below.)

Look For Businesses Where You Can Step In And Add Value

Another key quality to look for in a business for sale, is one where simple improvements (additions and/or subtractions), can significantly improve the bottom line. In short, areas where you can immediately add value by increasing revenues and decreasing expenses.

For instance, a lot of retiring Baby Boomers lack the marketing know-how, particularly in the modern era of social media and online advertising. Something as simple as running a few Facebook or Google ad campaigns can do wonders to the bottom line. In fact, one of the first questions Carl Allen likes to ask the seller is, “so how do you earn new business, what is your marketing strategy?” And 9 time out of 10, they’ll come back and say, “well this is what’s great about my business Carl. We don’t do any marketing. Its all word of mouth, referrals and repeat customers.” So he’s assured, when he puts his marketing team in and implements his marketing tools, that the business is only going to grow.

Another area lacking in many, already profitable businesses for sale, are structured systems. All too many owner-operated businesses are run in a haphazard manner and desperately need proper systems put in place. They require someone to come in and create standard operating procedures (SOPs), perhaps update inventory and point-of-sale systems, and simply reorganize things, thereby trimming the inefficiencies and waste, and improving the bottom line.

It’s A Numbers Game

Finding a good business is a numbers game. According to Allen, out of 10 conversations, you’ll find that a minimum of 2 or 3 owners are going to be super motivated, care more about legacy than monetary reasons, and are ready to do a favorable deal. So don’t just look at a single business. Look at 10 businesses from your specified category. And be prepared to walk away from a negotiation. Because there’s more than enough really good deals out there.

Kinds Of Businesses To Look At

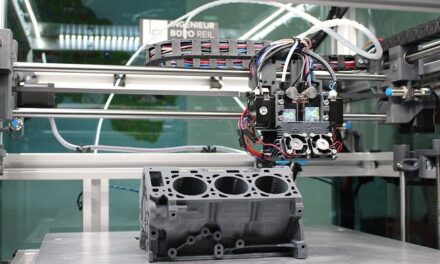

While the range of small businesses to look at are quite diverse – health services, construction, engineering, manufacturing, chemical processing, repairs and maintenance, transportation, marketing, ecommerce, retail, wholesale, hospitality, entertainment, etc. – Carl Allen advises to do deals which fall into one of the following three categories…

Businesses In Your Skill Set

Find a business that matches your skill set. Be careful about buying a business in a space that you know nothing about. If you have know-how in that space, you’ll be able to step in and add value right from the get-go.

Businesses In Which You Have A Passion

If you have a passion for that business, but you know nothing about the industry whatsoever, go and find somebody with the know-how and experience. Partner with them. They’ll help you do the deal and add value to the business, and then you can share the ownership with that person. And then go and buy some more.

Businesses In Which You Have Horizontal Skill Sets

If you have horizontal skill sets (your a dealmaker, accountant, lawyer, exceptional marketer, etc.), you can also find synergy in partnering with someone with the know-how and experience in that sector.

Four Methods Of Deal Origination

In Carl Allen’s opinion, deal origination is all about building relationships. You need to build rapport with people.

Build Relationships With Deal Intermediaries

In actual fact, only 20% of businesses end up selling through business brokers. The other 80% are sold through personal networks. When a business owner wants to sell their business, they generally go and talk with their wealth manager, CPA, tax adviser, attorney, banker or financier. These people have access to “off-market” deal flows – businesses that are for sale, but haven’t yet been listed with a business broker or online.

Your accountant, for example, has a vested interest to help you because if they have a business that they represent, they can act for that seller and get closing fees from the seller. And if they don’t have a client that meets your specifications – let’s say you’re looking for a coffee shop – they will still have a network of other local CPA’s that they can call up. “Hey, my client Joe is looking for a coffee shop. Do you have any clients that are looking to sell one?” In this scenario, your CPA is motivated to act for you on the buy side, do the due diligence on the numbers and help you close the deal, because you pay their fees as part of your closing costs once you take ownership of the business. Its all about finding an intermediary that can support you either on the buy side, or act for a client on the sell side, by helping the seller manage the deal through to its conclusion.

Leverage Social Media

Leverage Facebook, blogs, and online forums to make connections. Join the group, join discussions and add value. Once people get to know you and trust you, you can start asking questions. “Does anybody know a business for sale?” And then all the hands go up, says Allen.

Go Through Business Brokers

While Carl Allen says only 20% of deals go through business brokers, he still believes there are some good deals to be found. As a rule, he typically only works with brokers once the businesses have been listed for at least six months. Once the “tire kickers” have been around and no one wants to buy them, you can swoop in and structure a creative deal. Online business-for-sale websites include: BusinessesForSale.com, EmpireFlippers.com, etc.

Go To Events / Conventions

Carl Allen has another method of deal origination. He says he’ll call the organizer(s) of the events ahead of time and ask for an attendee list. Then he’ll shortlist the attendees down to the top 5 based on his own specification. Finally, he’ll create five small cards. On each card he writes down 5 things about the owner on the front, and 5 things about their business on the back.

Research is easier than ever thanks to social media. Find out where they like to travel, what sports teams they support, what kind of craft beer they like to drink, where they used to work before founding their business, etc. For business info, you can write down: what marketing channels they use, who their suppliers are, physical location(s) of their business, specifications about their products or services, etc.

Now, when you “accidentally” bump into these attendees during the course of the event, you’ll know everything about that person and their business, and easily build rapport and a relationship in a short amount of time.

Deal Negotiation – Buying A Business With Little To No Capital

The deals Carl Allen prefers to do are called leveraged buyouts (LBOs). In essence, you’re buying a business using other people’s money. To do that, the business needs to have assets (inventory, receivables, real estate, fixed plant and equipment) and/or cash flow. With business assets, its possible to borrow against those assets using third-party financing. And while this reduces the amount of capital a buyer needs to bring to the table, there’s an even better way to structure a deal.

The best way to structure a deal, in Carl Allen’s opinion, is not necessarily to negotiate solely based on the final selling price (on valuation), but on a deal structure using the business’s own cash flow. While a lot of buyers seem to get hung up on a fair price based on valuation (the average for small business is around a 2.5x multiple), Allen says he would happily pay a higher valuation, hence a higher price, if he could use the business’s cash flow to finance the deal.

The best way to structure a deal, in Carl Allen’s opinion, is not necessarily to negotiate solely based on the final selling price (on valuation), but on a deal structure using the business’s own cash flow. While a lot of buyers seem to get hung up on a fair price based on valuation (the average for small business is around a 2.5x multiple), Allen says he would happily pay a higher valuation, hence a higher price, if he could use the business’s cash flow to finance the deal.

In other words, Allen believes you’ll have a lot better chance of success if you just pay a higher multiple, but with the condition that you can make the majority, if not all, of future payments using the business’s own cash flow. That’s called seller financing.

Unlike real estate, where the buyer is expected to go out and get his/her own mortgage, or a business startup where you have to bootstrap or find your own financing, buying an existing business has the option of seller financing. In fact, over 80% of small business deals involve some kind of seller financing – like a seller-financed loan or an earn out (where you only pay if the business hits a certain level of revenue).

Seller financing increases your ROI, plus it makes the deal more equitable (since neither party is taking 100% of the risk). In the absence of seller financing (if you give the seller 100% of the money upfront), you have no recourse if you get into the deal and some of the conditions weren’t what you expected them to be. On the other side, the seller has security if the buyer defaults on their payments, since most deals are structured so that, if the buyer doesn’t pay their debt, the seller repossesses the business (just like if you buy a house on debt and the bank takes it over if you don’t pay).

What makes seller financed deals work so well, is you are forcing the seller to be your “first investor”. This tells you two crucial things.

- It tells you that the seller believes in the business (they won’t finance you if they think the business is about to crash and burn).

- It tells you that the seller has faith in your ability to run the business (since experienced owners/operators are the best qualified “experts” to make such a judgment).

To convey just how much he likes seller financing, Allen explains that if there’s a business doing $100,000 per year in free cash flow (which would put the value of the business at around $250,000), he’d happily pay $400,000 for that business if he could pay for it via seller financing over 10 years. Because he’s still making $60,000 in cash flow after he’s paid the seller ($400,000 x 10% = $40,000/year payments to seller). And $60,000 in annual earning is even before he’s grown the business.

And why would the seller refuse such a deal? If you were the seller, instead of getting $250,000 for your business (for a regular 2.5x multiple), then getting only 2% or so to park that money at the bank ($5,000/year in interest), you’re taking home $40,000 per year over 10 years. So its a win-win. You’re buying the business without using any financing (just the cash flow that the business generates), and the seller earns more than simply selling the business based on its valuation and putting the money in a risk-free investment.

To learn more about Carl Allen’s 10 step roadmap to business acquisitions, check out his online training program, Dealmaker Wealth Society. Inside his 10-step system, he’ll teach you how to find and buy a business using other people’s money. Then, how to grow it and how to sell it when you’re ready.