In recent years the world has progressively been pulled apart by social and geopolitical tensions. Conflict has increased all around the globe, as volatility and uncertainty has become the norm. Much of this discord, according to Neil Howe and William Strauss (authors of Generations and The Fourth Turning), stems from a generational change. As the baby boomers begin to retire and conclude their time in power, the millennial generation is starting to challenge the status quo.

In the following post, applying principles of the Fourth Turning theory, we try to understand what this transition in power has in store for us – in the 2020s and beyond.

The Fourth Turning Theory

The Fourth Turning theory, also known as the Strauss-Howe generational theory, describes a recurring generational cycle that follows a fairly predictable pattern. According to the theory, historical events are associated with a revolving series of four generational personas (archetypes). These include: Prophets, Nomads, Heroes, and Artists. When each archetype comes of age, they unleash a new era (turning) lasting around 20-22 years, in which a new social, political, and economic climate exists. The full generational cycle – four turnings – lasts a saeculum (a length of time roughly equal to a human life-span), which is approximately 80 to 90 years.

Cycles always follow the same order. First comes a High – a period of confident expansion as a new order takes root after the old has been swept away. Next comes an Awakening – a time of spiritual exploration and rebellion against the now-established order. Then comes an Unraveling – an increasingly troubled era in which individualism triumphs over crumbling institutions. Last comes a Crisis – the Fourth Turning – an era of destruction (often involving war or revolution), that is accompanied by a profound loss of trust in institutions. The Fourth Turning leads to a breakdown of the established social order and precedes a new era of growth and optimism. Together, the four turnings comprise history’s seasonal rhythm of growth, maturation, entropy, and rebirth.

Turnings & Archetypes

- The four turnings include…

- First Turning: High (growth)

- Second Turning: Awakening (maturation)

- Third Turning: Unraveling (entropy)

- Fourth Turning: Crisis (rebirth)

- The four archetypes include…

- Prophets (idealist) – come of age as self-absorbed young crusaders in an Awakening, when they attack institutional life in the name of personal and spiritual autonomy. (today’s Baby Boomers)

- Nomads (reactive) – come of age as alienated young adults in an Unraveling, during which time institutions are weak and distrusted, and individualism is strong and flourishing. (today’s Generation X)

- Heroes (civic) – come of age as team-oriented young optimists in a Crisis, when institutional life is destroyed and rebuilt in response to a perceived threat to the nation’s survival. (today’s Millennials)

- Artists (adaptive) – come of age as socialized and conformist young adults in a High, during which time institutions are strong and individualism is weak. (today’s Generation Z or “Homelanders”)

The Fourth Turning Is Upon Us

“History is seasonal and winter is coming. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and the twin emergencies of the Great Depression in World War II. The risk of catastrophe will be high. The nation could erupt into insurrection or civil violence, crack up geographically or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it.” (The Fourth Turning, Strauss & Howe, 1997)

The forewarning that William Strauss and Bill Strauss made in 1997, during a time of relative peace and stability, seems rather prophetic. A decade later, in 2008, the world was broadsided by the financial shock of the Great Recession. The event sparked social, political and economic volatility, discontent and a move towards populism and authoritarian rule. It marked a transition into the Fourth Turning.

End-Of-Cycle Fourth Turnings In Anglo-American History

- Glorious Revolution (1688-1689)

- American Revolution (1765-1783)

- American Civil War (1861-1865)

- Great Depression and World War II (1930s to early 1940s)

- Great Recession of 2008 until 20??

Projections For The “Crisis” (Fourth Turning)

How does Neil Howe foresee this chapter in history playing out? First, he asserts that one absolute rule of history is that a Crisis is marked by large, dictatorial, authoritarian and intrusive regimes. No exceptions. And holding true to this assertion, over a decade after the Great Recession, the COVID-19 pandemic has clearly potentiated authoritarian tendencies. The pandemic has served as a catalyst sparking growing discontent and further acceptance of restrictions on individual freedoms. For the world depends upon top-down institutions working correctly. And when they don’t – when it becomes apparent that they are impotent, sclerotic, and can’t effectively respond – people naturally gravitate toward increased authoritarian rule. Just like in the 1930s, when people wanted effective governance for the challenges of that era, the world has once again become enamored by authoritarian models and is beginning to pull back from globalism. This is a hallmark occurrence of the Fourth Turning.

Howe also says that during the Fourth Turning, fires can typically ignite anywhere. And when they do, crisis breed crisis. So what starts as a financial crisis, leads to an economic crisis, leading to social unrest, leading to politicians looking for enemies abroad, leading to trade wars, leading to a geopolitical crisis, and potentially, a full-scale military crisis. Once something breaks, its a bit like an avalanche advancing down a mountain, bringing everything it envelops along for the ride.

And once things start to snowball, issues that started out independently, often merge. For example, some people might be dismayed about inequality, others about global warming, others about cronyism and corruption, others about sovereignty. There are many different contentions one could look at. But typically, as the Fourth Turning reaches its climax, all these issues congeal into one huge Crisis. And all have to be solved with one enormous effort.

Reset Of Our Political And Financial Institutions

This where Neil Howe points out the positive aspect of the Fourth Turning. He maintains that in a Fourth Turning, societies in the heat of Crisis are actually empowered to confront, overcome and solve problems that seemed vastly too large to confront at a time of peace and equanimity. Big Problems only get solved in a time of Crisis. When everyone is energized and when all institutions are suddenly fluid, we have an opportunity to reset all the rules of the game. In order to create a new Golden Age, Howe maintains, you have to reforge it. You have to get everything molten hot and create a new template, a new paradigm.

We can take solace in lessons from history. Fourth Turnings, though violent, were also very creative times when we undertook great reforms. It was the Fourth Turning that brought about the United Nations, Bretton Woods, the IMF and the World Bank, creating a globalized system of trade that enabled decades of prosperity. It was also in the depths of the Great Depression in 1935 when the US passed and enacted the original Social Security Act.

Over the course of the 2020s we will undoubtedly tear down and rebuild our national and international institutions once again. Big reforms come about during dark periods in history. And while changes could easily include revolution, war and redrawn borders, we need to look on the bright side. We can look forward to a cleansing, a purge of the rampant inefficiencies, inequality, corruption and distortions that currently plague our political, financial and economic institutions. We can begin anew with a fresh, clean slate.

Projections For The Post-Crisis “High” (First Turning)

After the year 2030, in a post-Crisis world, the millennials will be moving into midlife and a new generation of socialized and conformist young adults – Generation Z (“Homelanders”) – will begin to come of age. Looking at the rhythms of history, Neil Howe explains how we can draw parallels between this upcoming post-Crisis era and the last post-Crisis era that followed World War II. In general, we can foresee an era in which there’s greater emphasis on community, the collective, risk-aversion, and the central planning.

More Conventions, Less Individualism

Neil Howe says that the new High, like that of the early 1940s, will see a world in which community will be much stronger. There will be a lot more conventions post-Crisis. The social and cultural center of gravity will be much more centered. With the passing of the Baby Boomers, who brought life and newness to society, things will seem tired and lack the vigor they once had. As opposed to the pre-Crisis world, there will be less individualism. The self-reliance we were accustomed to – starting in the culture of the late 1960s and 1970s, right through to the deregulatory push of the 1990s and 2000s – that will probably disappear. And certainly that loss of vitality will be felt in society.

Deglobalization

A move from individualism to the collective, according to Howe, most likely means a world in which there is less global movement, less global trade, and less global cross-border investment than we were previously accustomed to. The pendulum swing back towards globalization, that generally doesn’t happen until the Second Turning (Awakening) – after the post-Crisis High.

More Faith In Top-Down Planning

Just like in the post-war, post-Crisis era of the early 1940s, Neil Howe believes that we’ll see a renewed focus on top-down government planning. People forget that the early 1940s, though a time of growth and prosperity, also started out with a focus on central planning. Even in the US and UK, talented luminaries thought that maybe capital markets could be allowed to die out in the late 1940s. Through input-output matrices, top-down planning, pyramid organizational structures, new social benefits programs, they set out to strengthen the middle class. And though capital markets, of course, didn’t die, its important to remember that up until the 1950s and 1960s, equity markets and bond markets played a much smaller role in economic life back then. And there was a resurgence in the middle class.

Less Regard For Financial Markets

Neil Howe believes that attention paid to market fluctuations will be de-emphasized in the Post-crisis world. Unlike the zeal Baby Boomers and Generation X have had for the financial markets, the risk-averse Millennials and Generation Z just won’t share the same enthusiasm. In a more community oriented world that is more structured and more oriented around security, the appeal of financial marks – at least for a decade or two – will be somewhat devalued and play a more minor role in society.

Again, parallels can be taken from the past. Before we got off the gold standard, before countries had flexible exchange rates, and before there was massive cross-border investment, stock prices were just another number that few people paid attention to. And day-to-day fluctuations certainly didn’t guide company decision making. Unlike preceding generations that participated in the Roaring Twenties, the G.I. Generation of the 1950s were risk-averse.

Move Towards Risk-Averse, Passive Investing

Now, history is repeating. The infatuation of going mano-a-mano with the unregulated marketplace is ultimately going to be an elder point of view. As risk tolerant Generation Xers grows older, a risk-averse, passive investment strategy will become the norm. Already you can see evidence of this in automated investment services like Wealthfront, where the lion’s share of clientele belong to the Millennial generation. Its simply a natural progression – risk averse money goes into passive instruments. Millennials love to have targeted funds. They want to automatically allocate funds and have them expertly managed. Then they don’t have to think about it until retirement.

Conclusion

Despite many naysayers and policy thinkers who predicted a post-war depression, end of capital markets and lackluster growth in the post-Crisis era, none of their worst-case predictions ever materialized. Instead, 1946 was the start of an economic boom and a baby boom. The GI generation, who early on, weren’t given the respect they deserved, led the world into a period of growth and prosperity.

Drawing parallels to the Millennial generation, Howe maintains that its unfair to judge any generation at a young age. It’s very important to remember that before World War II, if you’d have asked most people what they thought about the G.I. generation (“the Greatest Generation”), no one would have thought they were great. You had these poor kids that got battered by the Great Depression, and no one knew what they were capable of.

Likewise, Neil Howe believes that the Millennial generation may not be getting the credit they deserve. You have this new, sheltered, community-oriented, conformist, achievement-minded, optimistic generation begin to come of age. And you could say a lot of bad things about Millennials as well. But the optimism and the can-do spirit of this generation has the same potential as the G.I. generation, to elevate society into a new era of post-Crisis growth.

Investing For The Fourth Turning And Beyond

Since turnings typically last 20-plus years, the Fourth Turning – the Crisis – will most likely last for the entirety of the 2020s and possibly beyond. That means everyone must make preparations for escalating trade wars, a debt and currency crisis, pension crisis, stock market crash, bond market crash, stagflation and/or hyperinflation. And that’s just a fragment of the problems on the horizon. There will also be increased civil unrest and escalating geopolitical tensions that lead to the risk of military conflict.

While the crisis of the Fourth Turning will eventually bring about a new era of reformed institutions, stability and prosperity, the concern of everyone should be getting across chasm of instability to the other side. Just like the era of the Great Depression and subsequent World War, we need to take a defensive approach to ensure wealth preservation. The following are investment ideas that should not only preserve your wealth, but perform well in the volatile and uncertain years ahead.

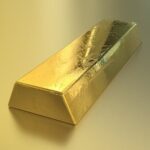

Physical Gold Bullion

Gold is the one asset class that has distinguished itself over and over again during times of Crisis. Gold is a currency whose exchange rate fluctuates, but it never becomes worthless and it never becomes worth less. If you own the physical form, without leverage, it will hold it’s purchasing power (and then some). When confidence in financial assets, property rights and political stability declines, investor demand for gold climbs. Investors want something safe that has no risk of impairment – which all other financial assets have plenty of. Gold is completely independent, without counterparty risk. It doesn’t need to be transacted in the financial system, meaning it does not rely on banks or financial markets. It’s not issued by anybody or approved by anybody specifically, so it’s independent. It’s also lasting, virtually indestructible, portable, malleable, and a lot of other things. In short, all these qualities together, make gold attractive in times when other financial assets become unreliable – in times of Crisis.

Gold is the one asset class that has distinguished itself over and over again during times of Crisis. Gold is a currency whose exchange rate fluctuates, but it never becomes worthless and it never becomes worth less. If you own the physical form, without leverage, it will hold it’s purchasing power (and then some). When confidence in financial assets, property rights and political stability declines, investor demand for gold climbs. Investors want something safe that has no risk of impairment – which all other financial assets have plenty of. Gold is completely independent, without counterparty risk. It doesn’t need to be transacted in the financial system, meaning it does not rely on banks or financial markets. It’s not issued by anybody or approved by anybody specifically, so it’s independent. It’s also lasting, virtually indestructible, portable, malleable, and a lot of other things. In short, all these qualities together, make gold attractive in times when other financial assets become unreliable – in times of Crisis.

Below are a few ways to invest in physical gold.

- purchase gold bullion

- store physical gold (in third-party bullion vaults) via a precious metals custodian

Bitcoin

Another asset class that some call the new “digital gold”, is Bitcoin. Unlike fiat currencies, Bitcoins can’t be printed and their amount is very limited. Only 21 million Bitcoins have ever been created, and will ever be created. And while it is still highly speculative, considering the ongoing central bank printing and uncertainty surrounding fiat currencies, the risk/reward profile is quite favorable. When events start unfolding, it has the potential to behave like gold on steroids. It has the potential for an asymmetric repricing, where even a very small amount of Bitcoin can act as a hedge against a shock in the financial system. *Just don’t invest more than you are willing to lose.

Platforms that facilitate the purchase of Bitcoin.

Crisis Stocks – For Deglobalization & Civil Unrest

The more you trade with your neighbors, the more interconnected you are, the less likely you are to go to war with them. Having said that, one of the hallmarks of the Fourth Turning is deglobalization – a move in the opposite direction. The pullback from globalism that started with Brexit and Trump’s Make America Great Again, has only accelerated in the face of the pandemic. Globally, tensions are on the rise. Therefore military (defense contractors) is our first investment idea. Even without a hot war (let’s pray for peace), the simple escalation in tensions around the globe results in a ratcheting up of defense spending. Stable businesses even in peacetime, defense contractors tend to have good balance sheets and their dividends provide a decent return on capital.

The more you trade with your neighbors, the more interconnected you are, the less likely you are to go to war with them. Having said that, one of the hallmarks of the Fourth Turning is deglobalization – a move in the opposite direction. The pullback from globalism that started with Brexit and Trump’s Make America Great Again, has only accelerated in the face of the pandemic. Globally, tensions are on the rise. Therefore military (defense contractors) is our first investment idea. Even without a hot war (let’s pray for peace), the simple escalation in tensions around the globe results in a ratcheting up of defense spending. Stable businesses even in peacetime, defense contractors tend to have good balance sheets and their dividends provide a decent return on capital.

Our second investment idea for the Fourth Turning is law enforcement. With civil unrest on the rise and a move towards authoritarianism, companies that supply police-tech, security equipment and crowd control tools, should do well for the entirety of the 2020s.

Finally, our third investment idea for the Crisis is self-survival and security. When people see things spiraling into disorder – when there are protests on the streets, fear and uncertainty – people tend to arm themselves and focus more on self-reliance, security and survival. Therefore, manufacturers of personal firearms, recreational firearms, outdoor supplies and accessories, should do very well for the remainder of the decade. And as an added bonus, several companies in this category also supply military and law enforcement branches as well.

Below we’ve listed 6 of our favorite Crisis stocks that fall within the categories of military, law enforcement, and/or self-survival and security.